Remote Mobile Number Ownership Transfer to Company name - No Telco Center Visit Needed

Seamless Mobile Ownership Transfer for Business: Your Guide to Tax & E-Invoicing Compliance

Mobile bill causing tax headaches or e-invoicing worries? Learn how to easily transfer ownership to your company for seamless compliance & deductions in Malaysia.

Real Case: Business Lost Control of Number Registered Under Ex-Employee

When you land on this page, you’re probably facing a similar issue:

A company mobile number is registered under someone else’s name—maybe a staff member who has since resigned—and now you’re stuck trying to regain control.

Let me share a real story from one of our clients.

📌 The Problem: business mobile number was registered under an ex-employee’s name

Some of our clients had a business outlet using a mobile number that was registered under an employee’s personal name. Over time, this number became the main line for WhatsApp communications and daily operations with customers.

However, after the employee resigned and returned to their hometown, the company ran into trouble:

💥 They could no longer claim the mobile bill as a tax-deductible expense,

because the line wasn’t registered under the company name.

To make things worse:

The SIM card was missing, so they couldn’t receive OTPs for verification.

The former employee was unreachable, and telco policy required both parties to be present at the service center to complete a name transfer.

The business was stuck.

They were still using the number for WhatsApp—but had zero ownership or control over it.

we handle everything from start to finish

✅ How We Solved It Handle This Remotely

Here have two possible solutions:

If the ex-employee could cooperate, they could visit the telco center and request a SIM replacement or help with a manual transfer to the company.

We processed a Remote Mobile Number Ownership Transfer — no center visit needed. Just provide the proper telco-required documents, and we handle the rest

✅ No need for both parties to meet

✅ No need to lose the number

✅ No disruption to WhatsApp

✅ And most importantly, the bill can now be claimed as a tax-deductible expense

In the end, the boss regained full control of the number under the company name—and solved both financial and operational risks.

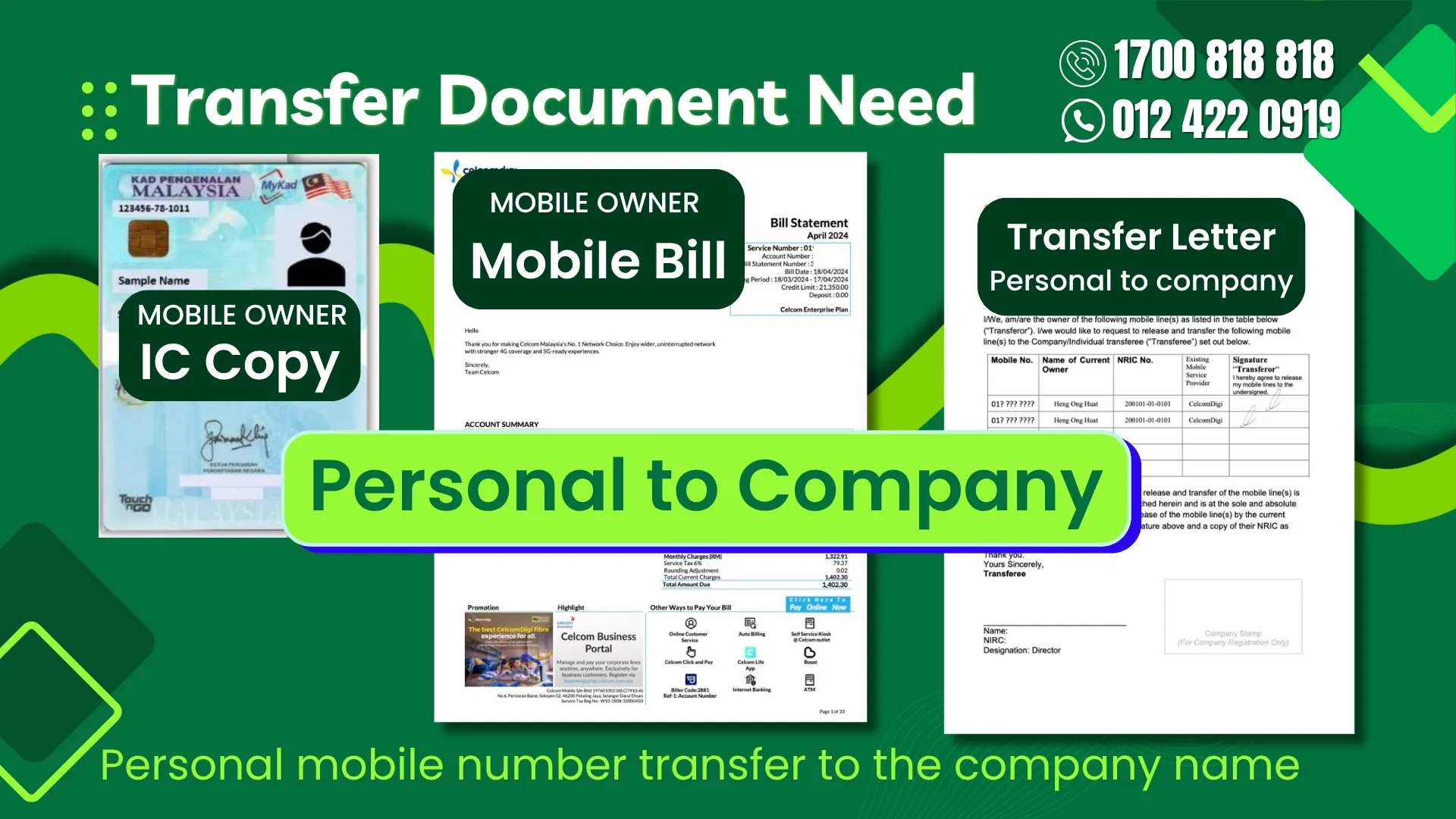

Personal Document need

Transfer Ownership Personal to Company

📌 IC Copy: front & Back

📌 Mobile Number

📌 Email

📌 Telco Bill (Maxis, CelcomDigi, U Mobile)

Personal Document need

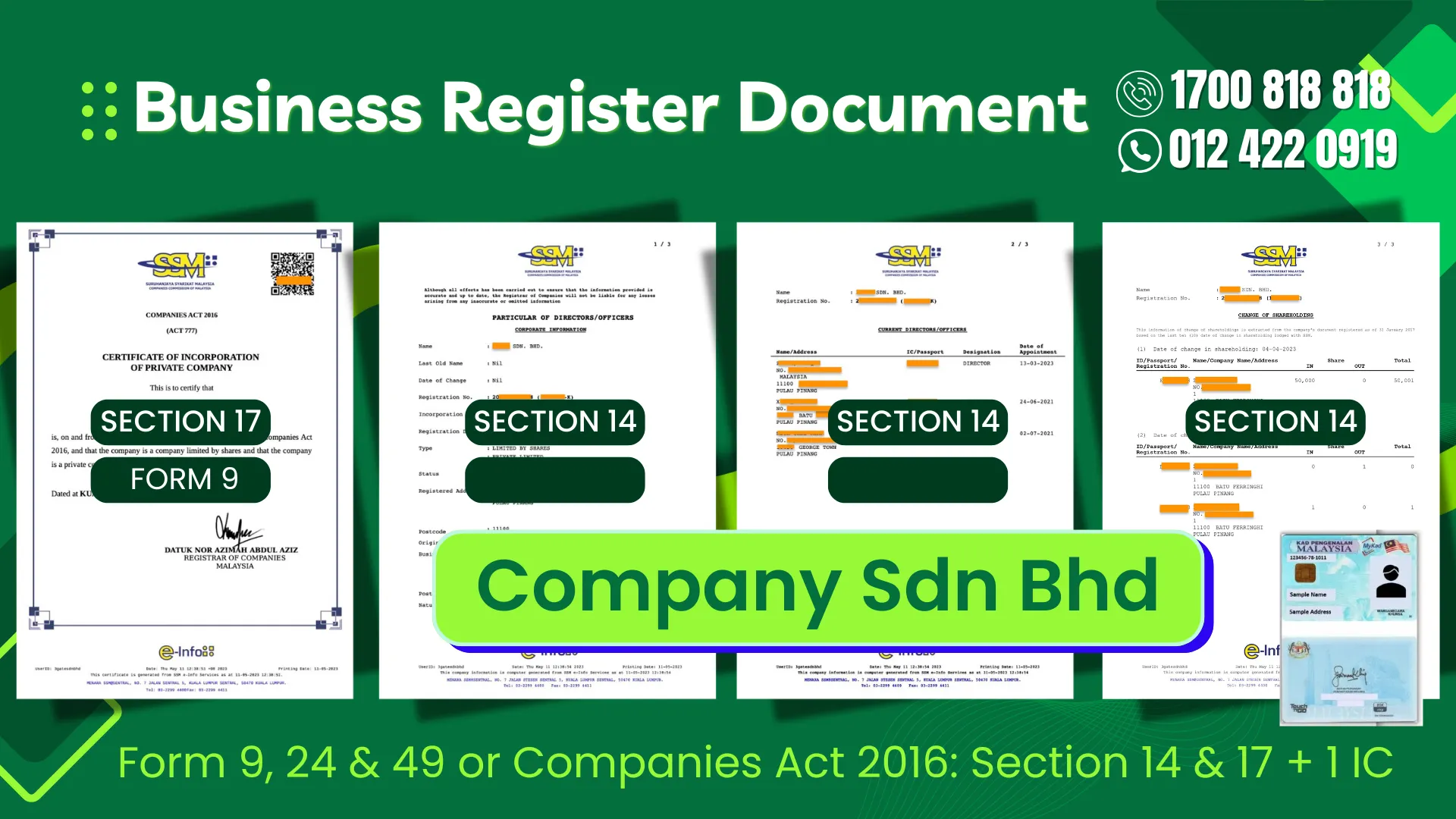

SSM for Sdn Bhd Document need as

Companies Act 1965 Form 9/13, Form 24 and Form 49 or

Companies Act 2016 Section 14 & 17

Pass 3 months Bank statement 1st & last page

One of Director IC Copy

Additional information:

📌 Delivery Address:

📌 Mobile Contact:

📌 Email:

📌 Company TIN number: (for e-invoicing purposes)

Contact Us

Dedicated customer service support

Submit the form and our dedicated support team will get back to you as soon as possible. We’re always happy to assist.

- Mobile: 012 422 0919

- HotLine: 1700 818 818

- Careline: 03 5888 8838

- email: bizcare@maxisbusiness.my