Why most of Malaysian businesses Transfer Ownership Mobile bill From Personal to Company Name

Mobile bill causing tax headaches or e-invoicing worries? Here discover why and how to Transfer Ownership from personal to company name, avoid tax scrutiny, ensure business compliance, and optimize tax deductions.

Stop Losing Money! Mobile Bill Transfer Ownership to Your Company & Claim 100% Tax Deductions

If you’re reading this, chances are:

📌 You’re planning to transfer your mobile number from personal to company name

📌 Or you’ve heard that not doing so could lead to penalties from LHDN (Malaysia’s Inland Revenue Board)

📌 Or maybe… you’ve already faced issues like failed tax claims, audit risks, or lost control of numbers

Whichever it is, let us say this first

We’ve helped many business owners just like you, complete help them mobile number transfer ownership to company name. The best part? No one had to visit any physical telco branch. Everything was done remotely, with proper verification and documentation.

Penalties for Incorrect or False Tax Claims, Mobile Bills Under Multiple Personal Names

If mobile phone expenses are submitted as company deductions—but bills are issued under different individuals (not company or directors) —LHDN may deem this as incorrect tax returns under Section 113(1)(a).

❗️ Penalty: Up to RM10,000, plus 200% of the undercharged tax amount

Only payment of monthly bill for internet subscription registered under own name is eligible for claiming lifestyle relief, hence prepaid plan is not eligible.

Transfer Ownership Personal to Company

Personal Document need as:

📌 IC Copy: front & Back

📌 Mobile Number

📌 Email

📌 Telco Bill

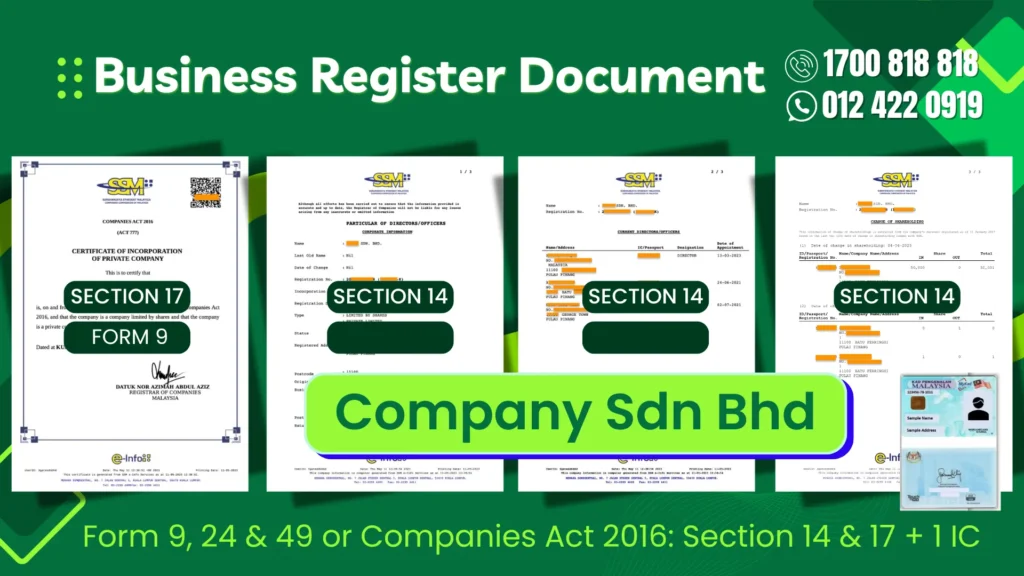

SSM for Sdn Bhd Document need as

Companies Act 1965 Form 9/13, Form 24 and Form 49 or

Companies Act 2016 Section 14 & 17

One of Director IC Copy

Additional information:

📌 Delivery Address:

📌 Mobile Contact:

📌 Email:

📌 Company TIN number: (for e-invoicing purposes)

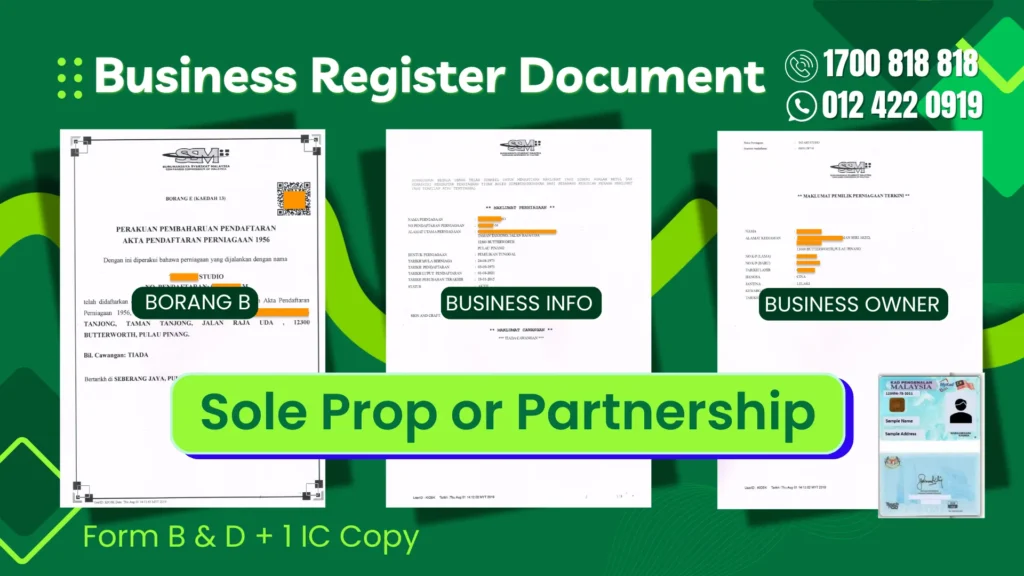

SSM for Sole Prop or Partnership:

SSM as Form B & D

One of Director IC Copy

Additional information:

📌 Delivery Address:

📌 Mobile Contact:

📌 Email:

📌 Company TIN number: (for e-invoicing purposes)

Certificate of professional firm

Certificate of professional firm

Firm Owner IC Copy

Additional information:

📌 Delivery Address:

📌 Mobile Contact:

📌 Email:

📌 Company TIN number: (for e-invoicing purposes)

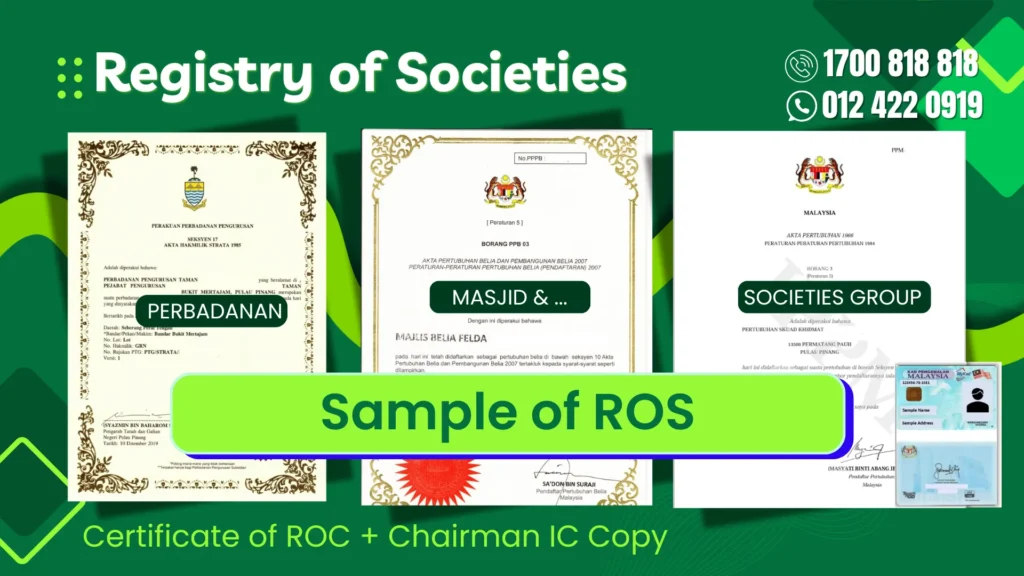

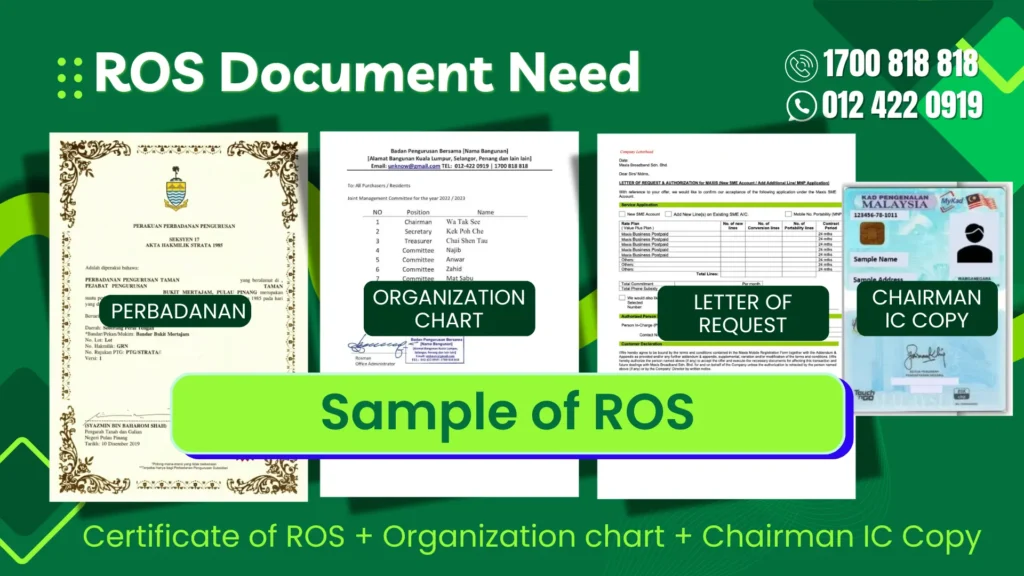

Registry of Societies

We can also assist you Transfer Ownership your current mobile number registration to entities under the Registry of Societies — such as Associations, Federations, Guilds, Institutes, and Societies.

Certificate of professional firm

Certificate Registry of Societies

Organizational chart

Letter of Request

Chairman IC Copy

Additional information:

📌 Delivery Address:

📌 Mobile Contact:

📌 Email:

📌 Company TIN number: (for e-invoicing purposes)

Got an enquiry on any of our Business Solution?

Contact / Whatsapp us or leave your contact details with us and we’ll call you.

Switch to Maxis Business Postpaid Document need

Want to know more? Contact us at 1700-818 818 or Whatsapp us immediately get connected our live human support.

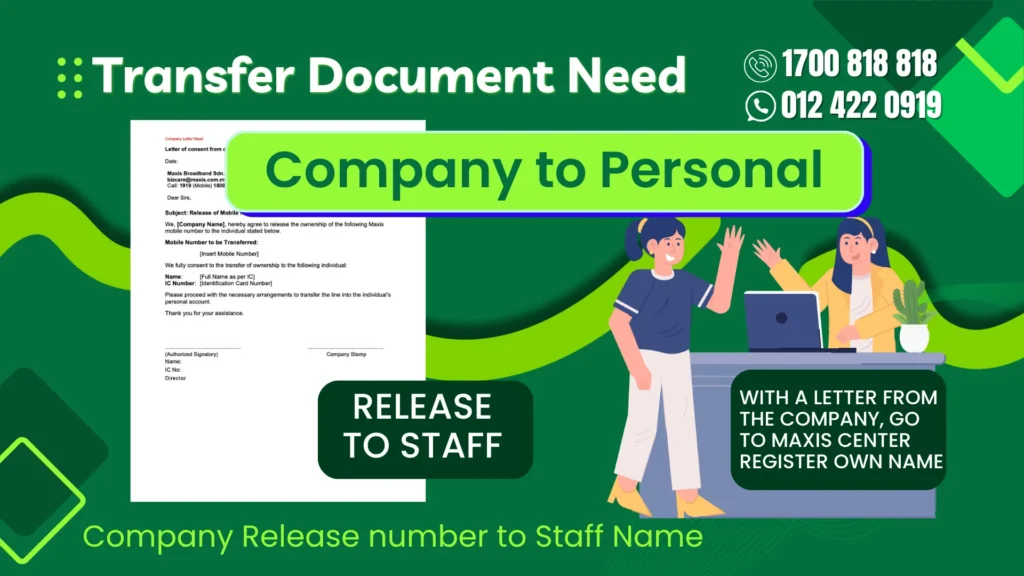

Transfer from company to personal name

✅ Some cases are possible to do smoothly,

❌ Some cases might not go through unless you visit the telco center.

If the person involved is cooperative, we may be able to help you handle everything remotely—without going to the center. Transferring a number from company name to personal name, or vice versa, can be tricky.

That said, if you know the process well, it’s actually not hard at all.

✅ It just requires proper documents and

✅ Most importantly, the cooperation of the person who currently owns the number (e.g., your staff).

So yes, it can be done—but only with clear coordination and understanding from both sides.

Company port their mobile numbers from one telco (donor telco) to another

Because many businesses are looking to cut costs and at the same time, ensure their mobile bills are done in a proper and tax-deductible way.

Whether you’re switching telcos to save money or to align your lines under your company name, we can help you handle the porting process smoothly.

✅ It’s easy

✅ And you can keep your same number without interruption.

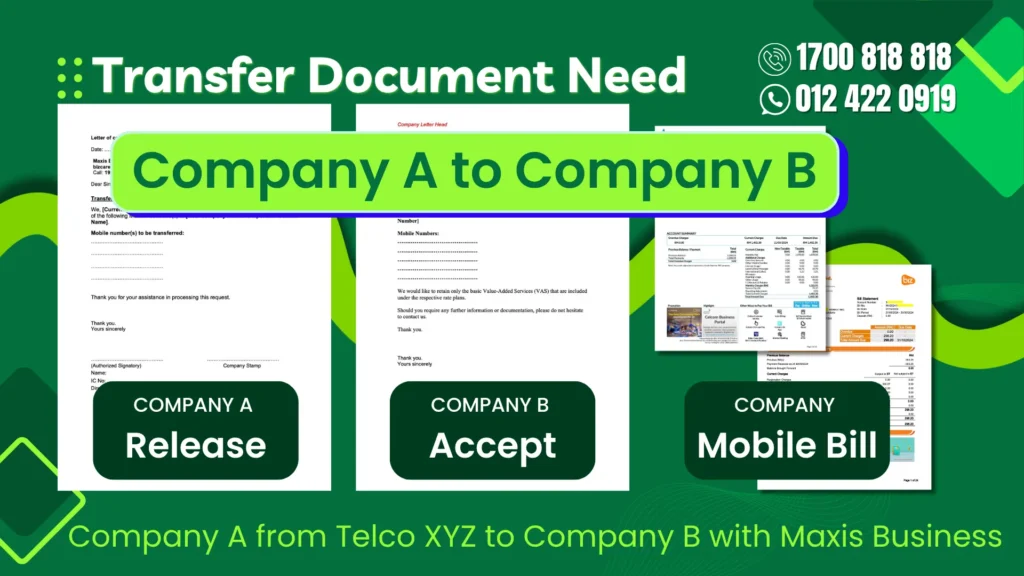

Transferring mobile lines from Company A to Company B

Many businesses are doing this to reorganize or reassign their phone numbers back to the correct entities—whether it’s a parent company, a newly acquired company, or a specific department.

The good news is: this process is possible and straightforward—as long as the mobile numbers are not tied to any active contract.

We’ve prepared all transfer document need as soft copy to help you transfer your mobile number from personal name to company name or company to company.

📄 You can download the file below file name anytime.

Contact Us

Dedicated customer service support

Submit the form and our dedicated support team will get back to you as soon as possible. We’re always happy to assist.

- Mobile: 012 422 0919

- HotLine: 1700 818 818

- Careline: 03 5888 8838

- email: bizcare@maxisbusiness.my